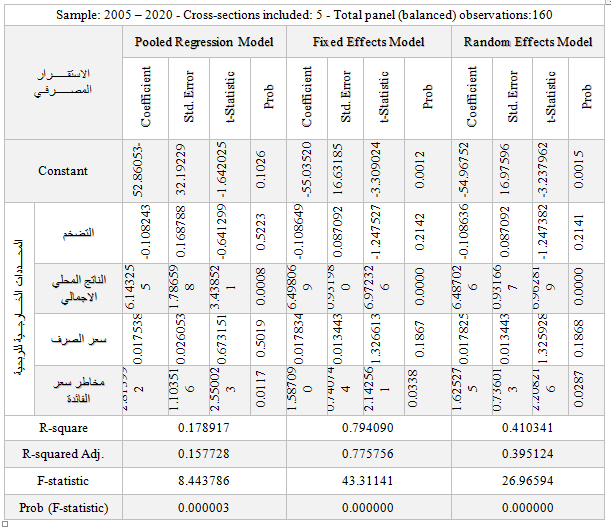

تحليل علاقة المحددات الخارجية للربحية وتأثيرها في الاستقرار المصرفي عن طريق الدور الوسيط لمؤشرات الربحية

دراسة تحليلية لعينة من المصارف العراقية الخاصة المدرجة في سوق العراق للأوراق المالية للمدة (2005-2020)

الكلمات المفتاحية:

المحددات الخارجية للربحية، الاستقرار المصرفي، المصارف التجارية الخاصةالملخص

يهدف هذا البحث إلى تسليط الضوء على علاقة المحددات الخارجية للربحية وتأثيرها في الاستقرار المصرفي بمؤشرات الربحية ، والمحددات الخارجية تمثلت مؤشراتها ( التضخم ، الناتج المحلي الإجمالي ، سعر الصرف، مخاطر سعر الفائدة ) كمتغيرات مستقلة في الاستقرار المصرفي العراقي باستخدام مؤشر (Z-Score) كمتغير تابع ، والمتغير الوسيط الربحية بمؤشراتها ( معدل العائد على الودائع ، معدل العائد على حق الملكية) وقد اعتمد البحث في الجانب التطبيقي على التقارير والكشوفات المالية المنشورة لعينة من المصارف (2005 – 2020 ) ، واعتمدت الدراسة تحليل البيانات (Panel Data Analysis) ، وتحليل (Path Analysis) ، ،باستخدام البرامج الإحصائية ، ومن اهم الاستنتاجات اذ اسهمت في زيادة اهتمام المصارف العراقية عينة البحث بمؤشرات الربحية من نجاح المصارف وزيادة عوامل الثقة والاطمئنان للمساهمين والمتعاملين مع القطاع المصرفي وجاءت توصيات هذا البحث اذ أظهرت النتائج الإحصائية بضرورة اهتمام المصارف المبحوثة بالمحددات الخارجية لما لها من اثار سلبية في الاستقرار المصرفي.

المراجع

Adiputri, Maima Widya &Indonesia , Depok, " Analysis of the Impact of State Governance on the Stability of Islamic Bank Across 20 Countries " , Advances in Social Science, Education and Humanities Research, volume 348 , 3rd Asia-Pacific Research in Social Sciences and Humanities , 2019.

Aladwan, Mohammad Suleiman " The Impact Of Bank Size On Profitability An Empirical Study On Listed Jordanian Commercial Banks” , European Scientific Journal December 2015 Edition, Issn: 1857 – 7881 (Print) E - Issn 1857- 7431 , Vol.11, No.34 , 2015.

Albulescu, Claudiu Tiberiu "Banks’ Profitability And Financial Soundness Indicators: A Macrolevel Investigation In Emerging Countries" , 2nd Global Conference On Business, Economics, Management And Tourism, 30-31 October 2014, Prague, Czech Republic, Procedia Economics And Finance 23 , 2015.

Alshubiri , Faris Nasif " Determinants of financial stability: an empirical study of commercial banks listed in Muscat Security Market ", A Journal of the Academy of Business and Retail Management (ABRM) , Journal of Business and Retail Management Research (JBRMR), Vol. 11 , Issue 4 , July , 2017

Anjarwati, Yerry Tri , Santosa, Siswoyo Hari ,& Badjuri " Analisis Perubahan Faktor Makroekonomi Terhadap Return On Assets (Roa) Perbankan Persero Di Indonesia Periode 2006q1-2015q4 (The Analysis Of Changing Macroeconomical Factor To The Return On Assets (Roa)Of State Owned Banking In Indonesia Since 2006q1-2015q4 Period ),", Artikel Ilmiah Mahasiswa, 2016.

Asma, Rashidah Idris, Fadli, Fizari Abu Hassan Asari, Noor, Asilah Abdullah Taufik, Nor ,Jana Salim, Rajmi Mustaffa &Kamaruzaman , Jusoff " Determinant of Islamic Banking Institutions’ Profitability in Malaysia" ,World Applied Sciences Journal 12 (Special Issue on Bolstering Economic Sustainability): 01-07, ISSN 1818-495, IDOSI Publications, 2011.

Bagh, Tanveer , Razzaq, Sadaf , Azad, Tahir ,Liaqat, Idrees & Khan, Muhammad Asif " The Causative Impact of Liquidity Management on Profitability of Banks in Pakistan: An Empirical Investigation" , International Journal of Academic Research in Economics and Management Sciences , Vol. 6, No. 3, 2017.

Bashir, Abdel-Hameed M “ Risk and Profitability Measures in Islamic Banks: The Case of To Sudanese Banks”, . Islamic Economic Studies, Vol. 6, No. 2, May. .1999.

Ben Moussa, Mohamed Aymen & Hdidar, Zohra " Bank Profitability And Economic Growth: Evidence From Tunisia" European Journal Of Economic And Financial Research , Volume 3 ,Issue 4 , 2019.

Bikker, Jacob A. , & Vervliet, Tobias M. , " Bank Profitability And Risk‐Taking Under Low Interest Rates" , Research Article, Int J Fin Econ, . Wiley On Line Library.Com/Journal/Ijfe , Doi: 10.1002/Ijfe.1595, 2017.

Brigham, Eugene F .and Michael C Ehrhardt, “Financial Management: Theory and Practice”,10th., Australia : Thomson Learning,2001.

Devi, Anila & Devi, Shila, " Determinants Of Firms’ Profitability In Pakistan", Research Journal Of Finance And Accounting Www.Iiste.Org , Issn 2222-1697 (Paper) Issn 2222-2847 (Online), Vol.5, No.19, 2014.

Farooq, Mohammad , Khan, Shiraz , Siddiqui, Atif Atique , Khan, Muhammad Tariq & Khan, Muhammad Kamran " Determinants Of Profitability : A Case Of Commercial Banks In Pakistan" ,Article Humanities & Social Sciences Reviews E-ISSN: 2395-6518, https://doi.org /10.18510/ hssr .2021 .921 , Vol 9, No 2, 2021

Frank, Murray. Z., & Goyal, Vidhan,. K.," Capital Structure Decisions: Which Factors Are Reliably Important?" Munich Personal Repec Archive, Financial Management, Online At Https://Mpra.Ub.Uni-Muenchen.De/22525/ Mpra Paper No. 22525, Posted 25 May Utc, 2009.

Fuadi, Saparuddin & , Sugianto" The Effect Of Inflation, Bi Rate And Exchange On profit ability In Sharia Banking Inindonesia Period Of 2009-2019 ", International Journal Of Educational Review, Law And Social Sciences |Ijerlas E-ISSN: 2808-487X , Volume 2 , Issue 1, 2022.

Haavaldsen ,Eirik &Fredrik , Hans . " Determinants and Effects of Corporate Currency Hedging" , Master Thesis in Financial Economics Norges Handel Shoyskole, This thesis was as a part of the Master of Science in Economics and Business Administration at NHH, Norges Handel Shyskole ,Bergen, Semester, 2010

Kosmidou, Kyriaki ., Tanna, Sailesh & Pasiouras, Fotios" Determinants of profitability of domestic UK commercial banks: panel evidence from the period 1995-2002", Published version deposited in CURVE June, Economics, finance and accounting applied research working paper series no. RP08-4, 2008.

Kuzmin, Anton " A Structural Model of Exchange Rate Dynamics", Review of Business and Economics Studies Volume 2, Number 3, 2014.

Mahshid, Deniz."Managing Interest Rate Risk :A case Study Of Four Swedish Savings Banks" , Master Thesis Magisteruppsats Industrial & Financial Management ,Goteborg University, 2004.

Martins, Agnes ‘Tokunbo " Basel II/III Implementation in Africa and the Impact on the Resilience of its Banking Sectors: A Case Study of Nigeria ", 2nd year PhD Finance, ICMA Centre, Henley Business School University of Reading, United Kingdom, 2020.

Muhani, Muhani , Digdowiseiso, Kumba & Prameswari , Kintan Mayang "The Effects of Sales Growth, Current Ratio, Total Asset Turnover, Debt to Asset Ratio, and Debt to Equity Ratio on the Return on Equity in Energy and Mining Companies", Budapest International Research and Critics Institute-Journal (BIRCI-Journal) , Volume 5, No 1, February 2022.

Ngepah, Nicholas ,Silva , Margarida Liandra Andrade da & Saba , Charles Shaaba " The Impact of Commodity Price Shocks on Banking System Stability in Developing Countries " , Article, Economies, https://doi.org/10.3390/ economies10040091,https://www.mdpi.com /journal /economies, Economies , 10, 91., 2022.

Ommeren, S.V” Banks' Profitability-An Examination of The Determinants of Banks' Profitability in The European Banking Sector”. Unpublished Thesis, Department of Accounting &Finance, Erasmus School of Economics, Erasmus University Rotterdam and Intern at Rabobank Nederland. .2011

Owoputi, James Ayodele , Olawale, Femi Kayode&Adeyefa, Felix Ademola " Bank Specific, Industry Specific And Macroeconomic Determinants Of Bank Profitability In Nigeria", European Scientific Journal September , Edition Vol.10, No.25 Issn: 1857 – 7881 (Print) E - Issn 1857- 7431, 2014 .

Ozili, Peterson K " Determinants of bank income smoothing using loan loss provisions in the United Kingdom ", Munich Personal RePEc Archive , Online at https://mpra.ub.uni-muenchen.de/ 112047 / , MPRA Paper No. 112047, posted 21 Feb 2022 05:02 UTC, 2022.

Powell , Robert J., &Vo , Duc H. , " A Comprehensive Stability Indicator for Banks ", doi:10.3390/risks8010013, www. mdpi. com/journal/risks. , Article Risks, Volume 8, Issue 1 , 2020.

Sarwar, Bilal, Mustafa,Ghulam,Abid, Aroosa & Ahmad, Muhammad " Internal and External Determinants of Profitability: A Case of Commercial Banks of Pakistan ", Paradigms: A Research Journal of Commerce, Economics, and Social Sciences, Print ISSN 1996-2800, Online ISSN 2410-0854, DOI: 10.24312/paradigms120106, Vol. 12, No. 1, 2018.

Swamy, Vighneswara " Testing the interrelatedness of banking stability measures" , Journal of Financial Economic Policy Vol. 6 No. 1, 2014

Tariq , Waqas , Usman, Muhammad, Mir, Haseeb Zahid , Aman , Inam & Ali, Imran " Determinants of Commercial Banks Profitability: Empirical Evidence from Pakistan" , International Journal of Accounting and Financial Reporting, ISSN 2162-3082, Vol. 4, No. 2, 2014.

Wahyudi, Sugeng , Nofendi , Deki , Robiyanto, Robiyanto & Hersugondo , Hersugondo " Factors Affecting Return On Deposit (Rod) Of Sharia Banks In Indonesia" , Verslas: Teorija Ir Praktika / Business : Theory And Practice , ISSN 1648-0627 / eISSN 1822-4202 http:/ /btp. Press .vgtu.lt , 2018

Wibowo,Edi , Utami, Setyaningsih Sri & Dewati, Alung Rufti Asmoro " The Effect of Return on Equity, Earning Per Share, and Net Profit Margin on Stock Prices of Banking Companies Listed on the Indonesia Stock Exchange for the Period of 2018 – 2020 " , Budapest International Research and Critics Institute-Journal (BIRCI-Journal) Volume 5, No 1, February, 2022.

التنزيلات

منشور

كيفية الاقتباس

إصدار

القسم

الرخصة

الحقوق الفكرية (c) 2024 علي احمد فارس، لمياء علي إبراهيم

هذا العمل مرخص بموجب Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

يحتفظ المؤلفون بحقوق الطبع والنشر لأوراقهم دون قيود.