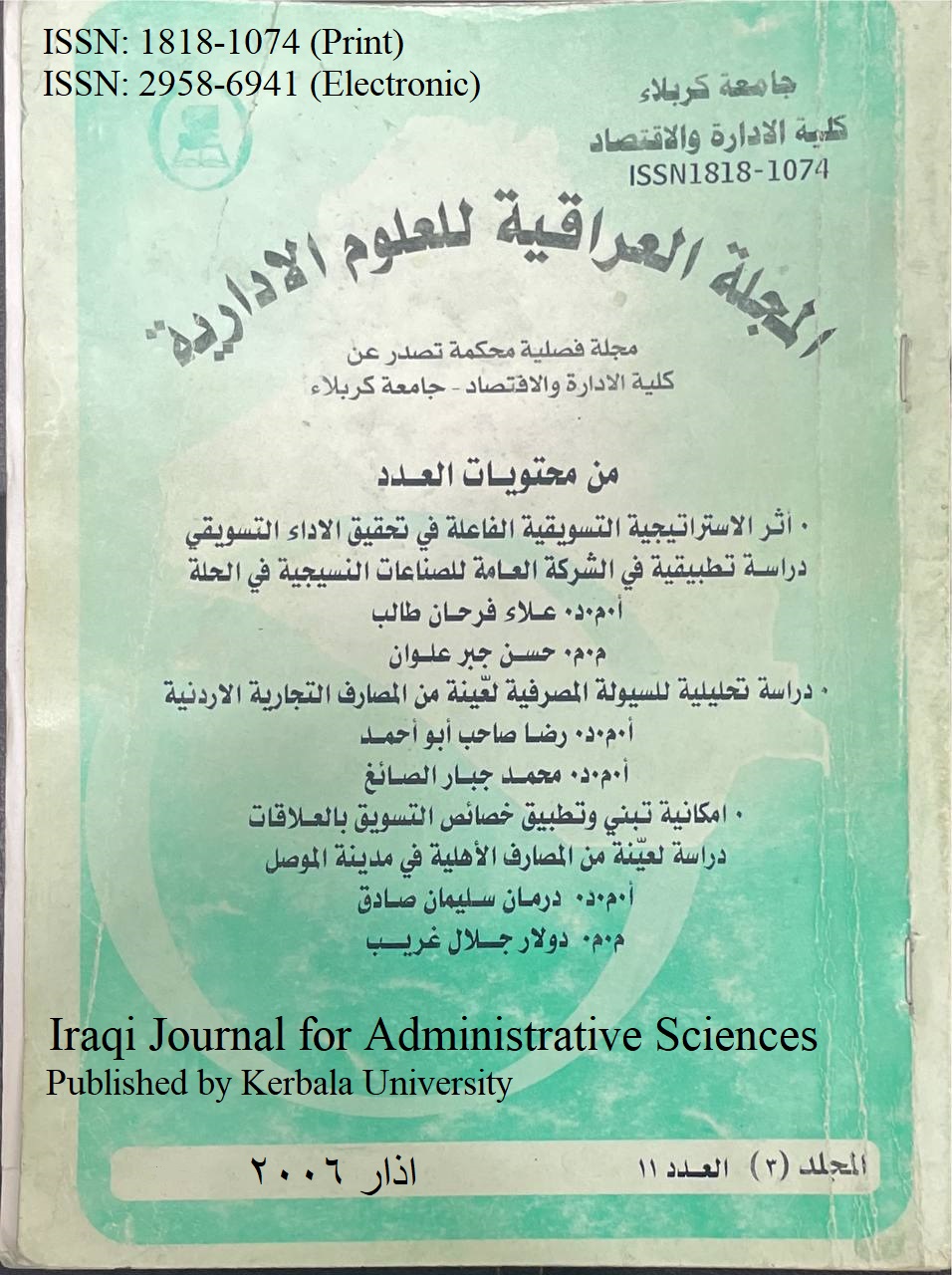

An analytical study of bank liquidity for a sample of Jordanian commercial banks

Keywords:

Bank liquidityAbstract

Banking liquidity is one of the important issues in commercial banks because of its clear impact on the subsidiary facilities provided to customers and those dealing with banks. The problem arises when liquidity is not available at banks, when the customer requests subsidiary facilities represented by loans and advances, which makes this customer turn to other banks. If the bank that deals with it is unable to meet the requirements that the customer, who may be a businessman or investor, wants, and on the other hand, maintaining high liquidity means that the bank’s management is unable to invest these funds and is also unable to exploit the available investment opportunities, and thus this negatively affects the bank’s profitability, and it may The research addressed this topic and came up with a set of conclusions and recommendations.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2006 College of Administration and Economics - University of Karbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.