Testing the multi-factor asset pricing model in the Iraqi Stock Exchange

Keywords:

asset pricing, Fama-French five-factor modelAbstract

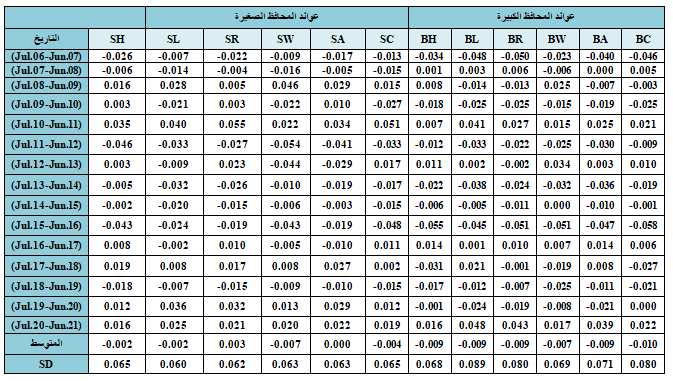

This study aims to test the effect of the variables of the French Fama model-with the five factors,on the required return on shares in the Iraqi stock market.Operational profitability premium(RMW)and investment premium(CMA)as independent variables,and in order to test the model, it was applied to the study sample,which was represented by(33)companies out of (130) companies listed on the Iraq Stock Exchange for the period from July2006to June 2021,and to achieve the goal of The study and its main hypothesis were tested.The multiple regression model was used through the Excel-v16program.Accordingly,the study concluded a number of conclusions, perhaps the most important of which are:There is a significant effect of the multi-factor asset pricing model on the required rate of return on shares, and the study came up with a number of recommendations,the most important of which are:The importance of investing in small-sized companies,because they achieve higher rates of return than in large companies.

References

الكــتــب

- Baker, Harold Kent & Filbeck, Greg, "Hedge funds : structure, strategies, and performance",1st Edition, Oxford University Press, United States of America,2017.

- Beccalli, Elena and Poli, Federica, " Bank Risk, Governance and Regulation", 1st Edition, Palgrave Macmillan, UK,2015.

- Brealey, Richard A.; Myers, Stewart C. and Allen, Franklin, "Principles of Corporate Finance " 11th Edition, McGraw-Hill, Irwin ,2014.

- Brooks, Raymond , "Financial Management: Core Concepts", Third Edition, Pearson Education Limited, England,2016.

- Cunningham, Lawrence A., "How to Think Like Benjamin Graham and Invest Like Warren Buffett",1st Edition, McGraw-Hill Companies, United States of America, 2001.

- Damodaran,Aswath, "Applied Corporate Finance: A User's Manual", Second Edition, John Wiley & Sons Ltd,2004.

- Duvaut, Patrick and Jay, Emmanuelle," Portfolio Diversification" , 1st Edition, ISTE Press Ltd and Elsevier Ltd,2017.

- Guo, Xin; Lai, Tze Leung; Shek, Howard and Wong, Samuel Po-Shing, "Quantitative Trading Algorithms, Analytics, Data, Models, Optimization",1st Edition, CRC Press :Taylor & Francis Group, United States of America,2017.

- McMillan, Michael G.; Pinto, Jerald E.; Pirie, Wendy L.and Venter, Gerhard Van de, Investments Principles of Portfolio and Equity Analysis , 1st Edition, John Wiley & Sons, Inc,USA,2011.

- Moosa, Imad A. and Ramiah, Vikash," The Financial Consequences of Behavioural Biases: An Analysis of Bias in Corporate Finance and Financial Planning",1Edition , Palgrave Macmillan, , 2017.

- Morgan, Matthew J., The impact of 9 11 on business and economics: the business of terror, 1st Edition, Palgrave Macmillan,2009.

- Ogilvie, John, "CIMA Revision Cards: Financial Strategy", 1Edition, Elsevier Butterworth-Heinemann, 2005.

- Pike , Richard and Neale,Bill " Corporate Finance and Investment :Decision and Strategies" 6th Edition , Pearson Education Limited , 2009.

- Rist Michael, Pizzica Albert J., "Financial Ratios for Executives: How to Assess Company Strength, Fix Problems, and Make Better Decisions",1st Edition , Apress ,2015.

- Sherwood, Matthew W. and Pollard, Julia, "Responsible Investing: An Introduction to Environmental, Social, and Governance Investments",1st Edition, Routledge, New York,2019.

- Szyszka, Adam, "Behavioral Finance and Capital Markets: How Psychology Influences Investors and Corporations", 1Edition, Palgrave Macmillan, United States, 2013.

- Tsay, Ruey S., "Analysis of Financial Time Series",Third Edition , John Wiley & Sons, Canada,2010.

البحوث المنشورة

- Balakrishnan, A.; Maiti, Moinak, and Panda, Pradiptarathi Panda. "Test of five-factor asset pricing model in India." Vision The Journal of Business Perspective,Vol. 22,No.2 ,2018, 1-10.

- Blanco, Belen. "The use of CAPM and Fama and French Three Factor Model: portfolios selection." Public and Municipal Finance Vol.1,No.2, 2012, pp 61-70.

- Cakici, Nusret. "The five-factor Fama-French model: International evidence.",SSRN,2015. https://ssrn.com/abstract=2601662Chan, Yue-Cheong.

- Dobbins, Richard, "An Introduction to Financial Management", Management Decision, Vol. 31 Iss. 2 ,1993.

- Fama, Eugene F., and French , Kenneth R., "A five-factor asset pricing model." Journal of financial economics,Vol.116,No.1 ,2015, 1-22.

- Fama,Eugene, and French ,Kenneth. "The cross-section of expected stock returns.", Journal of Finance,Vol.47,No.2, 1992, 427-465.

- Huynh, Thanh D. "Explaining anomalies in Australia with a five‐factor asset pricing model." International Review of Finance,Vol. 18,No.1, 2017.

- Jiao,Wenting, and Lilti,Jean-Jacques,"Whether profitability and investment factors have additional explanatory power compared with Fama-French three-factor model: Empirical evidence on Chinese A-share stock market." China Finance and Economic Review,Vol.6,No.2 ,2017, pp2-19.

- Mirza, Nawazish, and Shabbir, Ghalia, "The death of CAPM: A critical review." ,The Lahore Journal of Economics, Vol.10, No.2, 2005,pp 35-54.

- Munawaroh, U’um, and Sunarsih, Sunarsih. "The effects of Fama-French five factor and momentum factor on Islamic stock portfolio excess return listed in ISSI." Jurnal Ekonomi dan Keuangan Islam,Vol.6,No.2 ,2020, 119-133.

- Ozkan, Nesrin, "Fama-French Five Factor Model And The Necessity 0f Value Factor: Evidence From Istanbul Stock Exchange." , PressAcademia Procedia,Vol. 8, No.1,2018,pp14-17.

- Ragab,Nada S;Abdou,Rabab K, and Sakr,Ahmed M,"Acomparative Study between the Fama and French Three-Factor Model and the Fama and French Five-Factor Model: Evidence from the Egyptian Stock Market", International Journal of Economics and Finance; Vol. 12, No. 1, 2020.

الرسائل

- Maris, Georgios. "Application of the Fama and French Three-Factor-Model to the Greek Stock Market.", University Of Macedonia, (2009).

- Michaelides, "Michael, Revisiting the CAPM and the Fama-French Multi-Factor Models:Modeling Volatility Dynamics in Financial Markets", Dissertation submitted to the Faculty of the Virginia Polytechnic Institute and State University in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Economics, Science, March 2017.

- Nguyen, Trang; Stalin, Olivia; Diagne, Ababacar & Aukea, Leonard , "The Capital asset pricing model and the Arbitrage pricing theory." Gothenburg University, Financial Risk, MSA400, 2017.

- Pugdeepunt, Visarut, "Corporate Governance And Fama-French Five-Factor: Evidence From Stock Exchange Of Thailand", An Independent Study Submitted In Partial Fulfillment Of The Requirements For The Degree Of Master Of Science Program In Finance (International Program) Faculty Of Commerce And Accountancy Thammasat University Academic,2016.

البحوث غير المنشورة

- Panagiotakopoulos, Ioannis, and Vasileia Stavrakaki. "Fama French five-factor model testing in Europe.", 2016.

- Charitou, Andreas, and Constantinidi, Eleni. "Size and book-to-market factors in earnings, cash flows and stock returns: empirical evidence for the UK." Cash Flows and Stock Returns: Empirical Evidence for the UK (January 12, 2003) (2003).

- Gu, Qian,"Size and Book-to-Market Factors in Returns.", Utah State University ,(2015).

- Haqqani, Kanwal, and Rahman, Wali. "The Empirical Test of Fama-French Five-Factor Model: Evidence." (2020) .

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Economics and Administration College - Karbala University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.