The relationship between financial inclusion and banking stability

Keywords:

Financial inclusion, banking stability, central bank.Abstract

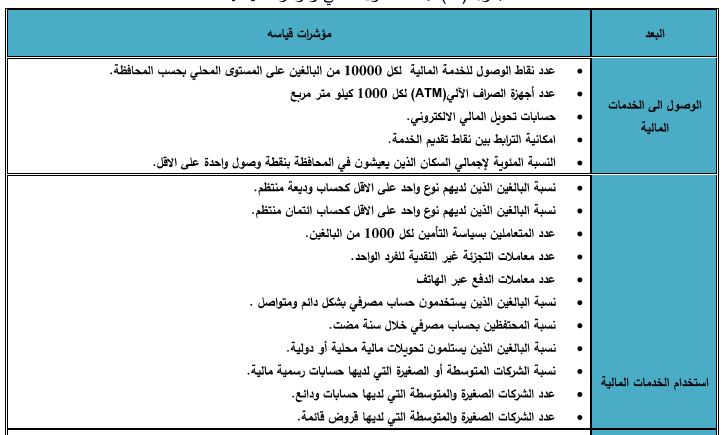

Financial inclusion is one of the priorities of monetary and financial policy in Iraq, because it has a major role in promoting the banking culture of the community and improve the performance of the banking and financial sector in Iraq, Monetary and financial policy makers have sought to deliver financial services to large segments of Iraqi society, especially disadvantaged segments of these vital services, The study was launched from a major problem that (What is the relationship between financial inclusion and banking stability in Iraq), which included a set of questions to give an integrated scientific vision showing economic efficiency and financial inclusion in promoting banking stability. It has been financial inclusion and stability of the banking data in the analysis of Iraq for the period (2010-2016) in terms of the correlation between the independent and dependent variables using a statistical program SPSS.V25 and the study found a group of the most important conclusions of the lack of correlation between the dimensions of access and the dimensions of the banking stability relationship. The results of the statistical analysis showed that there was no correlation between the use dimensions and the stability dimensions of (capital adequacy, return on assets, exchange rate risk, liquid assets on total assets), the correlation between loan size and GDP, (The quality of assets, the return on ownership rights, loans and advances to total deposits), the relationship between the size of deposits and GDP and the stability dimensions of (asset quality, return on ownership), and the correlation between the number of loans and the number of adults Resolution of b (the quality of assets, exchange rate risk, loans and advances to total deposits, liquid assets to total assets). The two researchers reached a set of recommendations, the most important of which is the need for the Central Bank of Iraq to expand the use of ATMs, points of sale and e-cards, for the important role it plays in providing electronic banking transactions and delivery to the largest segment of Iraqi society, as well as diversification of the Iraqi economy, which will have a positive impact on The stability of the bank through dealing with investors with banks for the purpose of supporting economic projects and then diversification of loans granted to different sectors and lack of focus in a given sector and thus provide sufficient liquidity to achieve banking stability.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.