Rent source of funding Rooms exploited the required level in the rural sample of developing countries

Keywords:

rent, untapped source of financing, rural, developing countriesAbstract

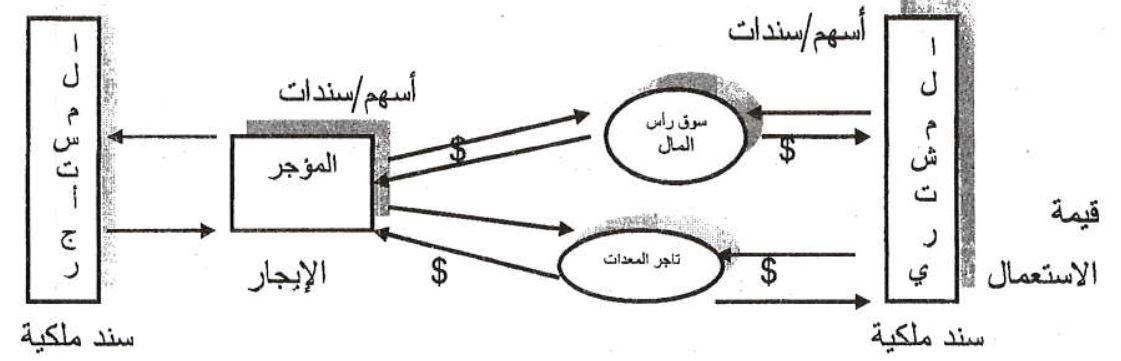

Often "Matvtqr rural enterprises, agricultural and non-agricultural, for access to long-term credit needed for the acquisition of capital assets so as to not possess the required guarantees. Most assets owned by rural enterprises can not be used as collateral, as that land titles are often non-existent, and movable assets like cattle organisms and materials inventory can not be used by law "as collateral. and the rent is a financing instrument that overcome these obstacles. In the lease has leased assets and allows the tenant of use in return for periodic payments. For most rural enterprises, the lease be a tool as well" for the purchase of assets (and not just use) ownership transferred to the tenant is often the end of the lease, whether the "automatic" or for a nominal fee. So This study aims to explore the importance and the possibility of leasing as a financing instrument to help rural enterprises to obtain assets that enhance productivity. To achieve this goal, analyzed the Importance of rent in the rural environment and see the experience and practice of a sample of companies that provide services for rent in rural areas. has also done research, comprehensive review of the advantages and risks and enabling environment for the development of the rental sector in rural developing countries. came out research with a number of conclusions of the most important: 1. that the rent is very important " as a tool for rural finance. and because of the increasing mechanization of agriculture in many countries and the increasing importance and the needs of industry, agriculture, the industrial and service sectors in rural areas provide a market "natural for rent. There are many parties providing services rental projects of rural agricultural and non-agricultural. It includes leasing companies and Mjhezwa equipment and agricultural cooperatives organizations and microfinance. but nevertheless, the rental sector in most developing countries is below the level of development required and provide services for rent in rural areas is very limited. "The lack of the legal framework is clear and legislation radical and accounting policies inadequate and Blog tax biased against the rent charged mostly development and the development of the rental sector. In addition, the very small number "of lessors have the experience to work in rural areas. that the lease for the benefit of both parties, landlord and tenant, and with legal and regulatory environment supportive and encouraging, it offers the landlords Mentoja" attractive "to finance fixed assets and the funding mechanism has reduced transaction costs and risk management. and across the lease be possible for tenants allocation of scarce financial resources to capital investment, new in the process of rapid contribute directly to increased production and revenues. The research was presented a number" of the recommendations of the most important need for concerted efforts at the level of international institutions (especially "The World Bank and IFC) and the regional organizations and companies, as well as at the level of local governments to support and enhance the rental sector in the rural areas of developing countries.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2009 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.