Evaluate the performance of the equity portfolio standard 2M and its role in the selection of efficient portfolio - Case Study in the analytical sample of listed companies in the Iraqi market for securities

Keywords:

Stock Portfolio Performance, 2M Scale, Efficient Investment PortfolioAbstract

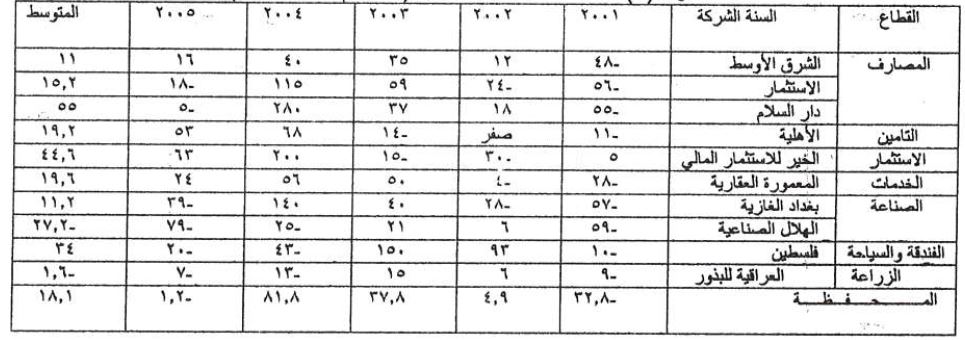

The subject of the investment portfolio of topics important financial and leading in today's world, especially after the developments in the world in the last two decades of the last century and the concomitant changes in political and ideological added a shadow over all areas of investment in the world, enjoined to investors wishing to invest her with the analysis and study on the This investment represented by the wallet using financial methods and standards specified in the evaluation of this type of investment as performance and indicate the role of these standards in the selection of the investment portfolio efficient through the use of a measure (M2) after one performance measures capsular modern as well as the two indicators of return and risk and indicate their roles in the selection of Depending on the portfolio of one of these without the other, as well as the impact of the use of a measure (M2) in the selection of this portfolio, so what was the most important conclusion of the research was: (the use of this measure (M2) has a significant impact in the selection of efficient portfolio compared Bmahari return and risk, in the number of companies which had been incorporated in the portfolio on the basis of this measure compared with the rate of return of the portfolio market hypothesis). The most important thing is the researcher recommends: (need to focus on the large investment in this area is important at the local level to the attributes of the ground at the global level, and the extent of activation and stimulate awareness of the Iraqi investors to conduct the necessary analysis and study using the standards supported in the evaluation of portfolio companies to be established before embarking on this process.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2009 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.