The impact of electronic trading on the volatility of stock returns - An Empirical Study in the Iraqi market for securities

Keywords:

The impact of electronic trading Volatility of stock returns The Iraqi market for securitiesAbstract

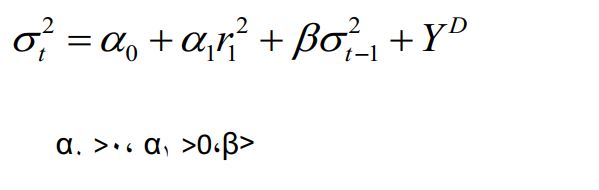

In this study, we use generalized autoregressive conditional hetroskedasticity (GARCH) methodology to examine the effect of electronic trading (ET) on the volatility of stock returns in Iraq stock exchange (ISE) . By using daily data of general stock price index starting from Jan., 9, 2009 and ends on July 30 , 2009, we examined the relevancy of the ET in explaining the time – varying volatility of stock returns , and study the change in volatility before and after the ET. We find that the ET has an impact on price changes , which suggests that more information being transmitted to the market as a result of the ET. In addition , the information is impounded more quickly due the applying of ET.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2010 College of Administration and Economics - University of Kerbala

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Authors retain the copyright of their papers without restrictions.